View: Bearish

Target Price: $67/bbl

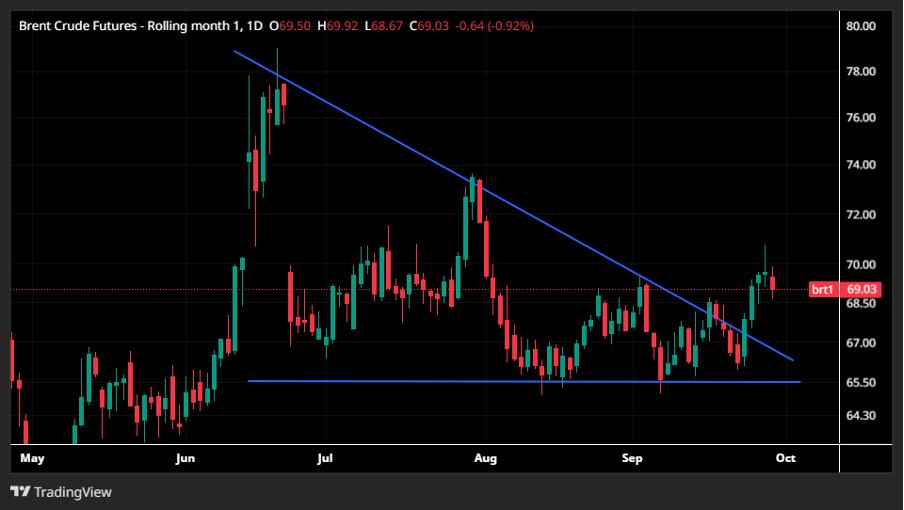

The M1 Brent futures contract rallied to nearly $71/bbl on 26 Sep, breaking out of a triangle they had previously consolidated around. However, prices met resistance here and sit at $69/bbl at the time of writing on 29 Sep. We expect them to continue to weaken in the near term, but anticipate support around the descending trendline formed by the triangle, currently around $67/bbl.

Key drivers:

- Macroeconomic uncertainty

- Positioning pointing to near-term unwinding

- Longer-term supply-driven floor in prices

Macroeconomy Uncertainty

This week brings a slew of economic data, including Chinese and US PMIs and US Consumer Confidence, culminating with the Non-Farm Payrolls on Friday. Risk assets such as oil may be impacted by this data, which could indicate the US Fed’s next interest rate move.

However, the threat of a US government shutdown on Wednesday overshadows the data releases. The market has reflected the uncertainty arising from the risk of a shutdown, with the US dollar index (DXY) briefly weakening below 98 this morning and gold making all-time highs. Although a weaker dollar tends to support crude oil prices, the uncertainty arising from a government shutdown could make players take less risk across risk assets, leading to a consolidation in oil prices.

Technicals and Positioning Pointing to Near-Term Unwinding

ICE COT data for the week ending 23 Sep highlighted a removal of managed-by-money longs and shorts in the week ending 23 Sep. This unwinding of positions comes amid open interest in Brent futures sitting just below 3mb, 10% above the Sep 2020 to Sep 2024 maximum, signalling an oversaturation of positions. With managed-by-money positioning skewed slightly long, this oversaturation could make it challenging to add fresh longs.

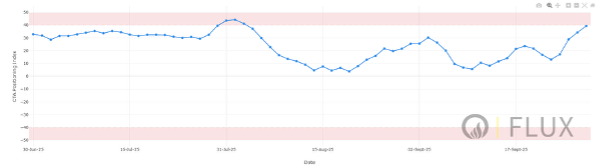

Flux Insight’s CTA data also flags this: a normalised view of CTA net length (pictured below, with z-scores from -50 to +50) shows positioning in ICE Brent inching towards the overbought territory of +40, which could lead to a bearish reversal in the short-term.

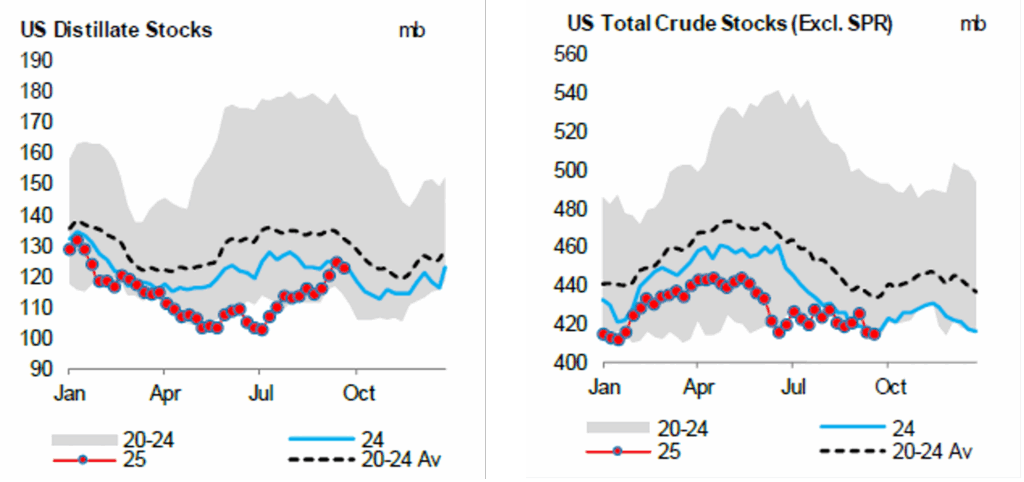

Potential Supply-Driven Floor in the Longer Term

Despite anticipated weakness in the short term, we highlight that last week’s 1.7mb decline in US distillate stocks flags caution regarding a possible shortage of diesel further into wintertime, when demand for heating oil and gasoil/diesel typically increases. US distillate stocks currently sit around 7% below the 5-year average, and this difference could widen should we see persistent w/w stock declines. These concerns, ahead of uncertainty over the intensity of winter this year, could provide a floor to prices and strengthen them further in the longer term.