View: Neutral/Cautiously Bearish

Target Price: $60-62/bbl

Last week, the Dec’25 Brent crude futures extended its decline, recording its third consecutive weekly loss as it fell to the low $60s level. The oil glut has gripped market narratives, with oil at sea at the highest level since 2020, while the IEA warns of a surplus of nearly 4mb/d in 2026. This week, we expect prices to remain supported above $60/bbl, with the following factors being crucial in affecting Brent’s sentiment:

Factors:

- Technical Support

- US-China Trade Negotiations

- Weakening Physical Market

Technical Support

Brent is approaching a critical juncture as the $60/bbl psychological support level comes into view. Prices are trading at their lowest level since May. While Brent has traded below $60/bbl on an intraday basis this year, prices have not yet closed below $60. Consecutive closes below this may trigger a bearish breakout, especially if longs are forced to stop out of their positions. Bearish momentum is strengthening, with the Average Directional Index (ADX) pointing higher over the past week. What’s more, the RSI is trending in the low 30s and not yet in oversold territory, suggesting room for further bearish action.

However, positioning data shows that speculators are close to being max short in Brent, therefore limiting the downside. ICE COT data indicates that money manager long positions have declined by 23% over the month, while the long:short ratio indicates a historically bearish skew (6th percentile for all weeks since 2013). CTA positioning in Brent is at an oversold level, at -49. Flux’s CTA index highlights that where Brent’s index is below -45, front-month prices revert up 77% of the time one week later, with an average gain of 2.53%. Hence, the overcrowding of short positions may make Brent more vulnerable to bullish catalysts.

US-China Trade Negotiations

Renewed tensions in the trade relationship between the US and China have shaken risk assets, including oil. Relations between the world’s two largest economies remain mired in uncertainty. Nonetheless, both sides have shown their willingness to engage in constructive communication and de-escalation, where US Treasury Secretary Scott Bessent is set to meet his counterpart, Vice Premier He Lifeng, in Malaysia this week. Trump has also come out on Truth Social, saying he’s “not looking to hurt China”, while listing out demands for a deal, including soybean purchases. Nonetheless, both sides have warned of further threats and retaliation, and any truce reached may be fragile. Given the easing rhetoric, markets appear priced for a positive outcome, so any breakdown of talks or a cancellation of the Trump-Xi meeting at APEC next week may reinforce bearish pressure in Brent.

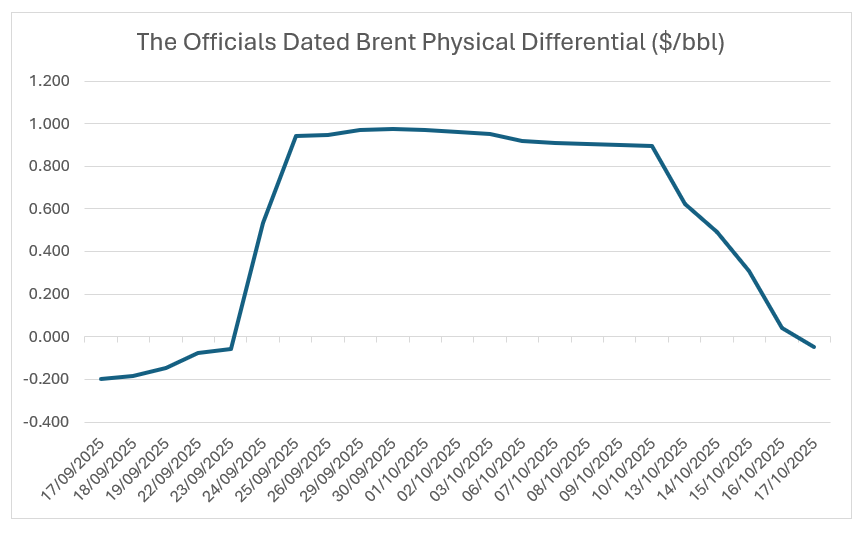

Weakening Physical Market

Physical sentiment in crude has deteriorated, as reflected in the increasingly large contango in deferred crude time spreads. This reflects the market’s pricing of an oil glut, where a deep contango is required to incentivise storage plays. The Dated Brent physical differential was previously upheld by a trade house that took barrels on expiry. Once the bids disappeared, the physical quickly fell below $0 within a week, reflecting an oversupplied market, in line with the glut narrative. Yet, November weekly CFD rolls are trading in a small backwardation at the time of writing, indicating hedge buying flow as refiners return out of maintenance. Despite the longer-term weakness that the entire market is expecting, crude may continue to find itself propped up in the near term.