Morning Macro 17th November

The OIS continues to reduce the chance of a FED rate cut on Dec 10th, now just 43% (with 14 Fed speakers this week). After opening weakly equities rallied into the close and open the week higher but crypto continues to struggle. Bitcoin down -24.6% from October highs and Ethereum -35.4%.

Data continues to show middle- and lower-income Americans are struggling:

1. U.S. foreclosures are up 20% from last year as Americans’ struggle with mortgage payments and rising costs

2. U.S. subprime auto loan delinquencies are at their worst level in more than 30 years

3. 875,000 U.S. homeowners are now underwater on their mortgages — the most in 3 years, per intercontinental exchange

4. 401k hardship withdrawals hit highest ever great leading indicator heading into 2026

5. Most Americans now live in areas already in recession: 88% of the U.S. population is in states facing economic downturn, per fed beige book analysis

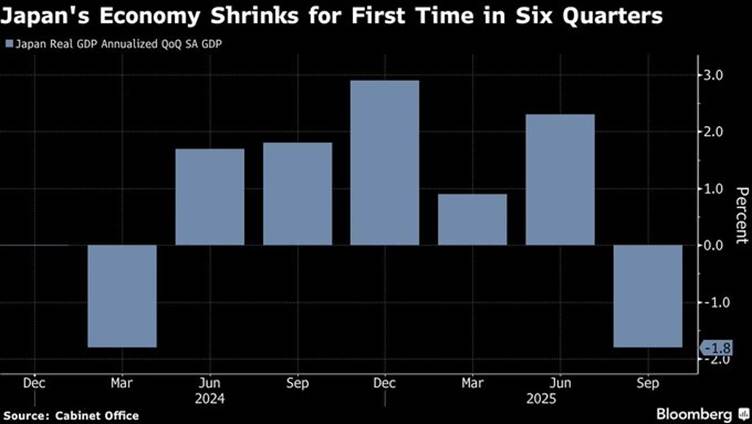

Japan’s 10Y Government Bond yield surges to its highest level since June 2008, and 20-year bond rises to the highest yield since 1999 on talks of a $110 billion stimulus package (while the central bank is about to hike rates). Behind door A you have a bond market crisis, behind door B you have a currency crisis!

*JAPAN 3Q GDP -1.8% ON ANNUALIZED BASIS; EST. -2.4% (Chart 1, Bloomberg)

On Wednesday, Nvidia will report earnings with an implied move of +/- 7.5% in the stock. With a $4.6 trillion market cap, this implies a $345 BILLION swing in market cap. That’s more than the entire market cap of all but 33 public companies in the world.

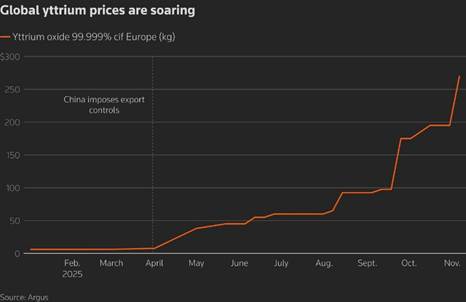

A new rare earth crisis is brewing as yttrium shortages spread, and China hasn’t shipped yttrium to U.S. since April. (Chart 2, Argus)

The week ahead:

Monday → U.S. government reopening

Tuesday → Fed liquidity injection ($10–20b), ADP employment

Wednesday →Nvidia earnings, FED minutes, UK & EZ inflation,

Thursday → September jobs report, Philly Fed manufacturing data, Japan inflation

Friday → UK retail sales, Global flash PMIs, UniMich consumer & inflation expectations

Total of 14 Fed Speaker Events This Week