Flux Insights makes its exclusive debut on Flux.live diving straight into the fast-changing landscape of the oil markets. Hosted by Head of Research Harry Tchilinguirian, and joined by analysts Harinder Sandhu and Mita Chaturvedi, the team breaks down the week’s biggest developments across crude and product markets.

Crude Sentiment Turns Bearish

OPEC+ has fully rescinded its 2.2 mb/d voluntary cut—but rather than strengthening prices, the move has triggered a bearish response. Brent has slipped out of the 70s, now trading around $66–68/bbl, with key support levels being tested. Saudi Arabia and the UAE have already increased production, adding to downside pressure.

Gasoil: From Peak to Neutral

On the product side, gasoil and diesel cracks have fallen, pressuring refining margins and prompting speculation of reduced crude demand.

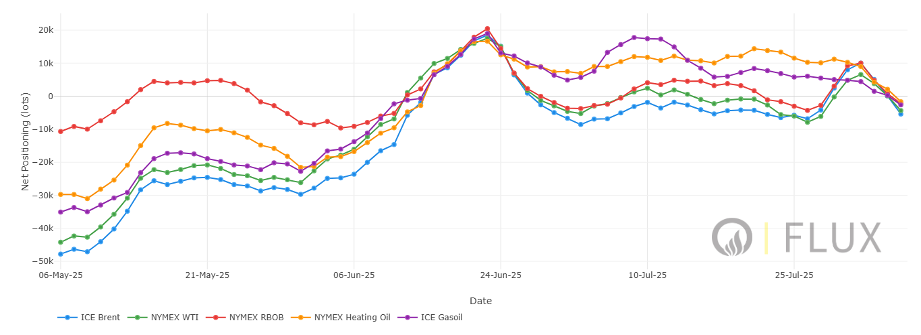

Positioning data shows funds pulling back after weeks of accumulation. Onyx’s proprietary positioning index flagged a sharp deleveraging—dropping from a high of 47 to a neutral 17—signaling an unwind of earlier bullish bets.

Source: Flux Insights

Brent & Gasoil: A Technical Breakdown

Technical analysis highlights bearish momentum across both Brent and ICE Gasoil:

- Brent has broken below the Ichimoku cloud, with MACD and RSI pointing to selling momentum.

- Gasoil futures also breached key support levels, with a bearish Marubozu candle confirming sell-side conviction.

These indicators, combined with weakening fundamentals, suggest more downside risk in the near term.

High-Conviction Trade: Short Sep’25 DFL

This week’s Alpha Trade Idea focuses on shorting the Sep’25 Dated-to-Frontline (DFL) swap. Onyx sees weakening refinery margins, additional OPEC+ supply, and a seasonal demand lull as reasons to expect the DFL to retreat from $0.90 toward a target of $0.80/bbl.

In the Crystal Ball

Looking ahead, Onyx forecasts Brent to remain under pressure, potentially closing the week in the $67–70 range. Positioning scores, momentum indicators, and macro fundamentals all suggest there’s more room for retrenchment.

CFDs and spread bets are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts lose money when trading in CFDs and spread bets. You should consider whether you understand how CFDs and spread bets work and whether you can afford to take the high risk of losing your money.