Morning Macro 5th November

Bitcoin is now down 20% since October 6th (Chart 1, TradingView) – yesterday’s selloff, saw it reaching the lowest point since June! The move was driven by an almost $1.3 billion liquidation in leveraged crypto positions.

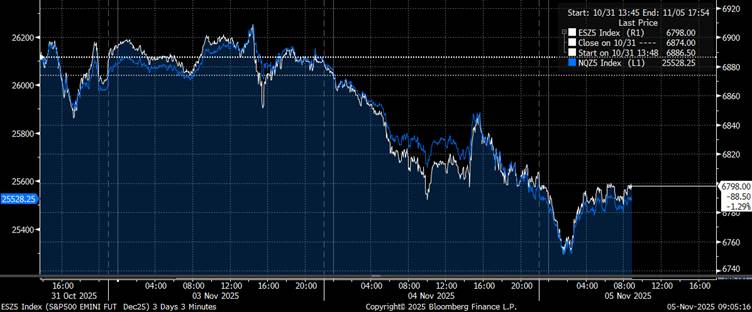

In the stock market, global equities slumped yesterday and have continued this morning in Asia, as investors are unwinding positions in overheated AI and tech stocks. The Nasdaq fell sharply, with Nvidia, Palantir, and other chipmakers leading declines amid fears that valuations had run far ahead of earnings and both S&P and Nasdaq e-mine futures even traded lower post New York’s close (Chart 2, Bloomberg). Meanwhile, the Nikkei closed 2.5% lower on the day.

China’s private RatingDog General Services PMI declined to 52.6 in Oct 2025 though still above expectations. This is the softest reading in the services PMI since July, pressured by a slight decline in foreign sales and a decline in employment. Input cost inflation rose to a year high due to higher wages and increasing prices of raw materials, while selling prices fell slightly amid higher competition. Taking this with the reported decline in manufacturing PMI earlier this week, the RatingDog Composite PMI stood at 51.8.

But China’s 10-year yields dropped near its lowest level in three months at 1.73%. The PBoC announced it will resume its government bond purchases after a 9-month hiatus, net injecting 20 billion yuan ($2.8 billion) of liquidity via buying government bonds.

What Fed rate cut? When a central bank cuts short-term borrowing rates but interbank lending remains at the same levels, something already screams in the money markets. SOFR was seen yesterday trading at a 32bps above the IOER set by the Fed (Chart 3, Bloomberg) – banks are screaming for cash, hence no surprise the Fed is restarting the printers at a current balance sheet of $6.6 trillion! Last week, the spike was attributed to fiscal year ends etc, but when a $4-5 trillion market in daily flow experiences these widening rates, something is about to crack.

Gold prices remain pressured around the $4,000/oz marker, with the 10-day MA now presenting near-term resistance (Chart 5, TradingView). A wave of persistent ETF withdrawals has driven gold’s pullback. Short-term support now sits around $3,940/oz, with more significant support at the $3,900/oz handle.

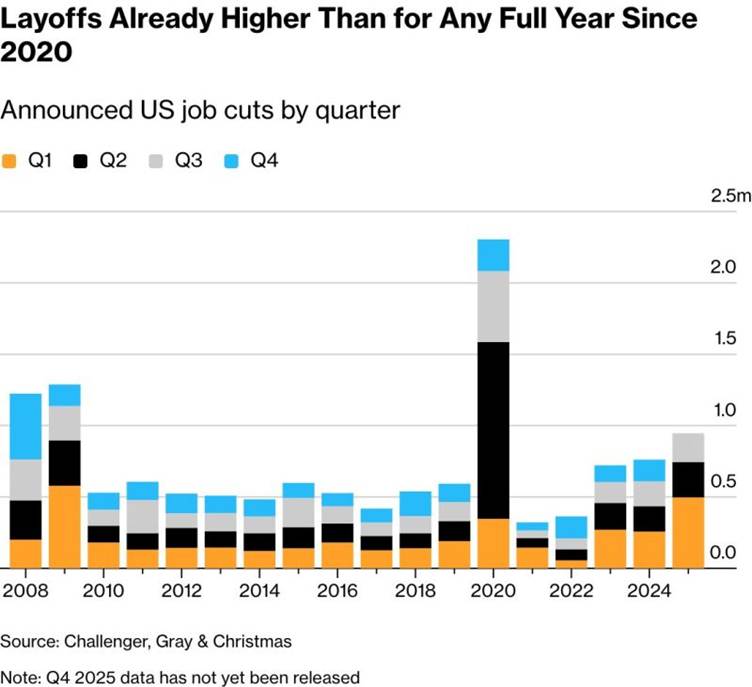

2025 has now been the year with the most job cuts since COVID! YTD approximately 950k jobs have been cut (Chart 4, Challenger, Gray & Christmas) – although the US government has contributed to nearly a third of those cuts. “We’re not just in a low hire, low fire environment anymore. We’re firing.” – Dan North, Allianz Trade. Amazon, Target, Starbucks and Paramount have all announced recently that they are cutting jobs!

Meanwhile, German factory orders rose 1.1% m/m in September, marking the first increase in orders since April. This rise was driven by increases in the manufacture of electrical equipment (9.5%), aircraft, ships, trains, military vehicles (7.5%), and the automotive sector (3.2%). Orders for metal products fell 19% following large orders in August. Still, on a Q/Q basis, factory orders declined 3.3% in Q3 2025.

And French industrial production surprised to the upside, as it came at 0.8% higher m/m in September, driven by strong recoveries in transport equipment and electronics manufacturing.

Data releases today – Euro Area PMI, GB Services PMI, ADP Employment, US ISM PMI