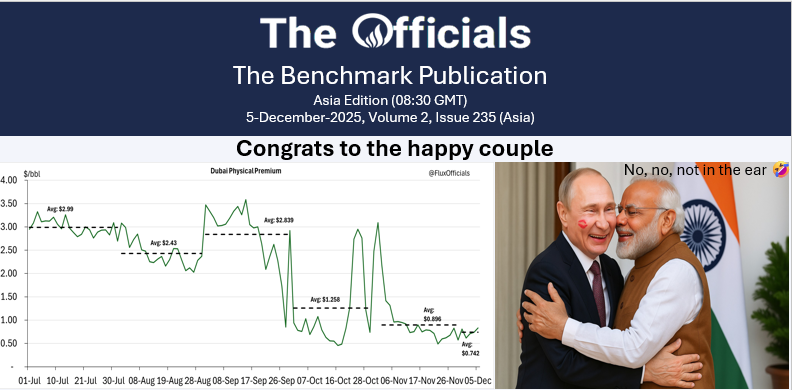

Oct’25 Brent futures rose in the early morning to $67.94/bbl at 08.37 BST before dropping to $67.60/bbl at 11.28 BST (time of writing). The US Treasury sanctioned Greek shipping entrepreneur Antonios Margaritis, his network of companies, and nearly a dozen vessels for facilitating Iranian oil exports that fund Iran’s weapons programs. At the same time, the State Department targeted two Chinese crude oil terminal and storage operators—Dongjiakou Port in Shandong and Yangshan Shengang in Zhejiang, for handling millions of barrels of Iranian-origin oil, marking the fourth round of sanctions on Chinese terminals. India pushed back against US criticism, with Foreign Minister S. Jaishankar saying the government is “perplexed” by threats of punitive tariffs. He stressed that Washington itself had urged New Delhi in recent years to help stabilize global energy markets, including by purchasing Russian oil. Despite the US pressure, India has reiterated its close ties with Russia and signaled it will continue buying Russian crude. Angola’s oil production fell below 1 mb/d in July for the first time in over two years, averaging 998,757 b/d versus a forecast of 1,073,542 b/d, highlighting its struggles since quitting OPEC in January 2024. Despite leaving the cartel to escape quota limits and boost output, Angola’s production remains stagnant, constrained by aging fields and years of underinvestment. With crude output in long-term decline from a 2008 peak of 2 mb/d, the country is now turning to natural gas projects to better monetize its energy resources. Serica Energy reported the first oil lifting at the Triton FPSO since production resumed in July, following a suspension in January due to Storm Eowyn. Output has averaged 20,000 boe/d net in recent weeks and is set to rise as additional wells at Evelyn, Gannet E, Guillemot West, and new Evelyn and Guillemot North West wells come online. The company maintained full-year guidance of 33,000–35,000 boe/d, after averaging 34,600 boe/d in 2024, with shares rising 1.6% in London. China’s Sinopec announced two major shale gas discoveries at the Hongxing deposit in central-southwestern China, with reserves exceeding 100 bcm, highlighting strong resource potential despite challenging geology at depths of 3,300–5,500 meters. A test well boosted output from 89,000 to over 300,000 cubic meters per day, underscoring commercial viability. The find comes weeks after Sinopec certified 147 million barrels of shale oil reserves at the Fuxing field in the Sichuan basin, the region’s first predominantly oil-rich play. Finally, at the time of writing, the front spread (Oct/Nov’25) and six-month (Oct/Apr’26) Brent futures spreads stand at $0.52/bbl and $1.55/bbl, respectively.v