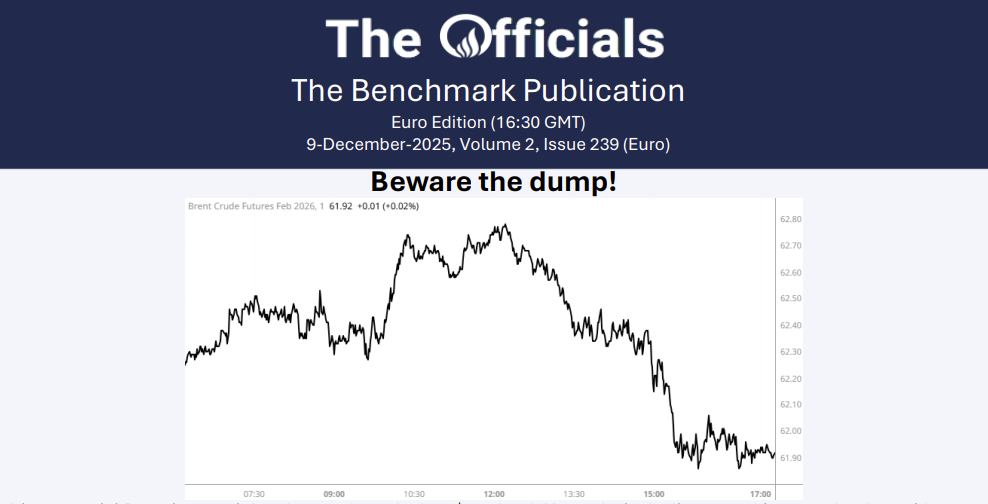

The Jul’25 Brent Futures contract saw prices rally to $62.00/bbl at 10:54 BST before falling off to $ 61.57/bbl at 11:50 BST (time of writing). In the news, President Trump said both Russia and Ukraine want to settle the war, linking Russia’s apparent willingness to recent oil price drops. Trump suggested Putin is more open to peace, citing the Russian leader’s proposed three-day ceasefire to mark the anniversary of the end of WWII. In other news, the House Natural Resources Committee is pushing a major oil and gas drilling overhaul as part of the budget reconciliation bill, aiming to ramp up lease sales on federal lands and waters. The plan includes 30 lease sales in the Gulf over 15 years, plus sales in Alaska, the Arctic National Wildlife Refuge, and the National Petroleum Reserve. By using budget reconciliation, the bill can bypass Democratic opposition and head straight to a Republican-majority Senate. Diamondback Energy says US onshore oil production has likely peaked and could start declining this quarter due to falling oil prices and reduced drilling activity. Frac crew counts have dropped 15% this year, with further declines expected, especially in the Permian Basin. The company, along with Coterra Energy, is cutting spending and scaling back drilling plans, blaming the slump on President Trump’s tariff policies that have hurt oil demand and prices. Finally the front-month Jul/Aug an d 6-month Jul/Jan’26 spreads are at $0.40/bbl and $0.58/bbl respectively.