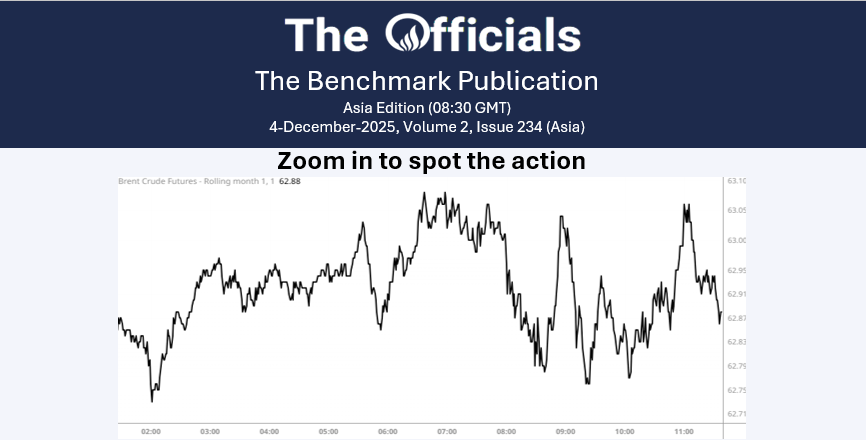

The Feb’26 Brent futures contract closed above the $63/bbl handle on 04 Dec, where it continues to stand. We saw resistance at $63.40/bbl at 09:30 GMT this morning, with subsequent support at $63.10/bbl at 10:20 GMT. At the time of writing, at 10:40 GMT, prices stand at $63.25/bbl. This morning’s resistance level aligns with the 20-day moving average, which has capped gains all week. Russian President Vladimir Putin and Indian Prime Minister Narendra Modi met at a New Delhi summit on 5 Dec, marking President Putin’s first visit to India in four years. The two leaders are expected to discuss topics including energy and defence. In an interview with India Today, President Putin challenged US pressure on India not to buy Russian fuel when the US could purchase Russian nuclear fuel. Indian state refiners Indian Oil Corp (IOC) and Bharat Petroleum Corp have placed January orders for Russian oil from non-sanctioned suppliers amid widening discounts. In other news, Equinor has made two new discoveries of gas and condensates in the North Sea, with initial estimates indicating the reservoirs could contain 30 to 110mb of recoverable oil equivalent. In macro news, German industrial orders climbed 1.5% m/m in October, exceeding market forecasts of 0.5% but slowing from an upwardly revised 2% m/m in September. Finally, the front-month (Feb/Mar’26) and Feb/Aug’26 Brent futures spreads stand at $0.40/bbl and $0.98/bbl, respectively.

Flux Insights

Our team of skilled analysts, by utilising the depth and breadth of Flux's proprietary data, position ourselves at the cutting edge of market analysis. This unique vantage point grants us an unparalleled perspective in the market, enabling us to identify emerging trends and lucrative opportunities.

Overnight & Singapore Window: Brent sits rangebound above $63/bbl

The Feb'26 Brent futures contract closed above the $63/bbl handle on 04 Dec, where it continues to stand. We saw resistance at $63.40/bbl at 09:30....

Share on

Our team of skilled analysts, by utilising the depth and breadth of Flux's proprietary data, position ourselves at the cutting edge of market analysis. This unique vantage point grants us an unparalleled perspective in the market, enabling us to identify emerging trends and lucrative opportunities.