Morning Macro 15th December

U.S. 30-year yield rallies 5bp as global debt concerns grow again and U.S. 2s10s curve continues to steepen, the front held down by weak data and Trump’s imminent dovish Fed pick, while the back end continues to steepen on global debt worries and concerns about Fed independence. These trades are derailing the equity uptrend (Nasdaq -1.9%), meanwhile Platinum continues its breakout, and gold closes in on new all-time highs. This is a big week for data (US payrolls, CPI, UK employment & CPI, & flash PMIs) and central bank meetings (BOE & BOJ)

China retail sales continue to disappoint +1.3% (estimated +2.9%). Property investment is down further with -15.9%YoY YTD and worryingly, fixed asset investment is down -2.6%.

BOJ IS SAID TO START SELLING ETF HOLDINGS AS EARLY AS JANUARY

TESLA U.S. SALES DROP TO NEARLY 3-YEAR LOW IN NOVEMBER DESPITE LAUNCH OF CHEAPER MODEL Y AND MODEL 3 – COX DATA

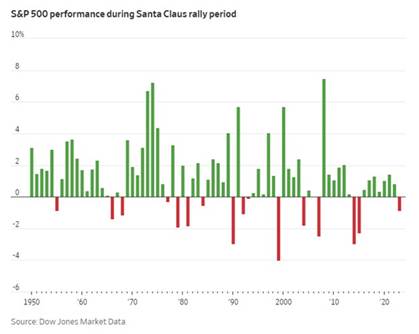

The Santa Claus Rally (last 5 trading days of December, and first 2 of January) has averaged 1.1% rally since 1950. (Chart 1, Dow Jones Market Data).

Oracle stock falls over -7% on reports that some of their data centres for OpenAI have been delayed from 2027 to 2028.(Chart 2, Bloomberg)

Broadcom down 11.4%.

Howard Marks at Oaktree: “I’m concerned that a small number of highly educated multi billionaires living on the coasts will be viewed as having created technology that puts millions out of work” “This promises even more social and political division than we have now, making the world ripe for populist demagoguery.”

Barron’s 2026 stock picks move from tech into defensives. (Chart 3, Barrons)

U.S. LAYOFFS ARE ON TRACK TO EXCEED GREAT FINANCIAL CRISIS LEVELS: U.S. EMPLOYERS ANNOUNCED 1,170,821 JOB CUTS IN 2025, THE SECOND-HIGHEST TOTAL IN 16 YEARS

Data this week

Tuesday – UK employment, US payrolls & retail sales, EZ flash PMIs

Wednesday – UK & EZ CPI

Thursday – BOE, ECB, rate decisions, US CPI, Japan CPI

Friday – BOJ rate decision, UK retail sales, UniMich consumer sentiment