Although prices approached $73/bbl last week, the Oct’25 Brent crude futures closed below $70/bbl on Friday following a soft US nonfarm payrolls reading. Meanwhile, over the weekend, it was announced that OPEC+ has completed the unwinding of its 2.2mb/d of voluntary cuts, by notionally raising its output by 547kb/d in September. This week, we expect prices to trade between $67 and $70/bbl. The key factors influencing the crude market this week are as follows:

- Trump’s Ultimatum on Russia

- Technicals / Market Positioning

- Weakening Refinery Margins

Last week, President Trump presented a shorter deadline for Russia to agree to a ceasefire in Ukraine, which is set to expire this week on 8 August. Severe tariffs were threatened, including 100% on Russia, with their trading partners also facing secondary sanctions. Meanwhile, a bipartisan bill (Sanctioning Russia Act of 2025) has been proposed by Congress, which includes a 500% tariff on imports from nations purchasing Russian oil, gas, and uranium. However, the mechanism for enforcing any potential new sanctions and their effectiveness is unclear. Moreover, previous experience shows that Trump’s deadlines are often not set in stone and subject to change. As Trump dials up his bellicose rhetoric towards Russia, the market will look for clues regarding progress in peace negotiations, sanctions threats, and their implementation.

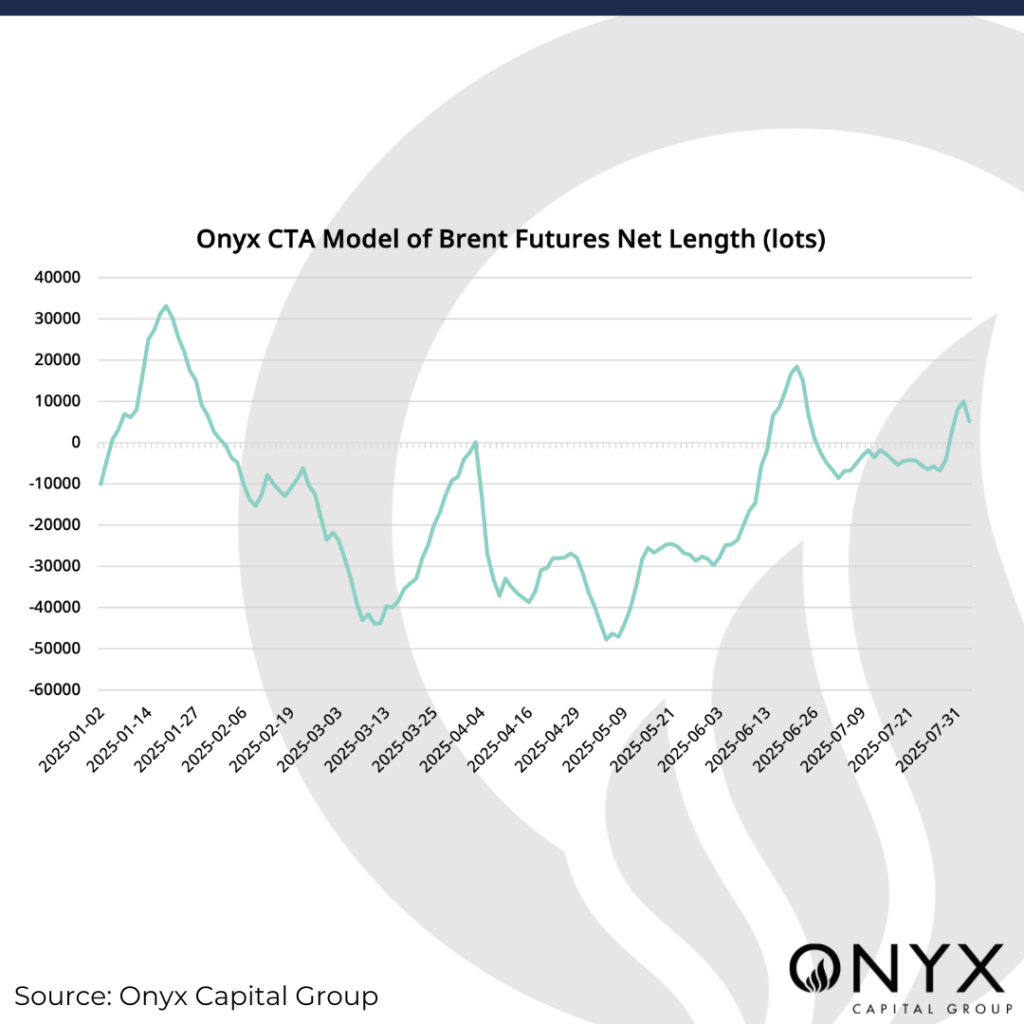

From a technical perspective, Brent is in a relatively balanced state. Prices are sandwiched between the structural 100-day and 200-day moving averages, delineating support and resistance levels. Last week, prices attempted, but failed, to break above the upper span of the Ichimoku cloud and instead retreated to the cloud’s lower span. Bullish momentum is fading, as indicated by the weakening RSI and MACD. Regarding positioning, our CTA model projects a softening of Brent futures net length on 4 August. Bollinger band widths remain relatively narrow compared to June-July levels, suggesting that a break beyond key support or resistance levels could trigger a sustained move.

Refinery margins sharply corrected lower over the week, a bearish factor for crude demand. The M1 European refinery margin fell from $9 to $7/bbl w/w to the lowest level since June. Faltering distillate cracks primarily drove the weakness, as the Sep’25 crack fell from $25 to $22/bbl. In addition, lower fuel oil cracks compounded the refinery margin weakness. Previously, stronger margins were a bullish driver for crude demand, especially from refineries, widening prompt differentials. Conversely, lower refinery margins may now reduce crude demand in the physical market and pressure the differentials lower in Brent futures spreads and Dated Brent.