Edge Updates

Dated Brent Report – Brent Synchronisation

It was quite the turnaround in Brent this week. Markets did a quick 180 as Middle East tensions de-escalated following Iran's telegraphed attack at a US military base in Qatar, in retaliation for American strikes against its nuclear sites. The geopolitical risk premium popped like a balloon. Bullish momentum was already waning before that, given the market's muted reaction on Monday's open, alongside the presence of Eni and Shell in the physical window, selling Forties. So synchronised were the directions of Brent futures and Dated. The futures rally on 13 June magnified the squeeze on deliverable supplies in Cushing, tightening the market and buoying Total's bids in the North Sea physical. DFLs were sent to the stratosphere, with Jul'25 touching $2/bbl. But as the old adage goes, what goes up must come down. Since the geopolitical risk deflation on 23 June, Brent spreads and DFLs are back to square one, before the geopolitical rally. The forward curve is implying weaker, especially the prompt week of 30-04 July. Glencore joined in on the selling party on 24 June, offering Midland, while BP put a Midland cargo into chains, the first of the month. We expect this trend to continue, but the fate of the prompt rolls will depend on how much the physical weakens, forming a basis for our dual trade idea. The front (July rolls) are slightly oversold, while the back (August rolls) is more overbought. Even at lower levels, there is a lack of buying, apart from refiner bids. As Dated weakens, it may be more difficult to fix arbs from the US to Europe, especially amid higher freight rates. Demand outlets would need to come from Chinese players lifting Forties, which is currently setting the curve. Stronger refinery margins may provide renewed support, especially as we've observed hedge selling flows of cracks with the refinery margins forward curve shifting noticeably higher. However, the market is more risk-off, given the elevated, headline-driven volatility recently. Despite our cautiously bearish views, renewed geopolitical headlines could see another upside breakout and volatility spike. Open interest is above average in Jun'25 contracts, but is trending in line with the 5-year average in Jul'25, underscoring the relatively subdued interest by the market. The question now becomes, how low does Dated Brent go? Prices have retraced below pre-event rally levels, but remain high on a notional basis. There is room to go longer, but are we approaching a consolidation?

Dated Brent Report – I Feel It Fading

Well, the bull run did happen, and it was the perfect storm. Peak summer demand. Backwardated prompt spreads. Refineries are back from maintenance. Gold rush. The Dated structure saw a good rally with Total bidding the physical, and the June and July DFLs surpassed $1/bbl, and the bulls were rewarded for their patience, with the recent run likely funding their summer holidays. The rally was well telegraphed, but we do not think the rally has a further leg up, and hold a cautiously bearish view in the short term as the bulls fade out. The 16-20 Jun week is implied at nearly $1/bbl in the physical, but the bulls are in no rush, with the market seemingly happy with the $0.80/bbl level in the physical differential. Despite continued bids from Total and friends, we see this as an attempt to support the physical, rather than to push it higher. Whilst strong buying in the paper was seen on 6 June, it was not by the players with the ability to move the physical. With prompt weeks implying higher than the physical, rolls could roll down and see selling into pricing.

Latest News

Edge Updates

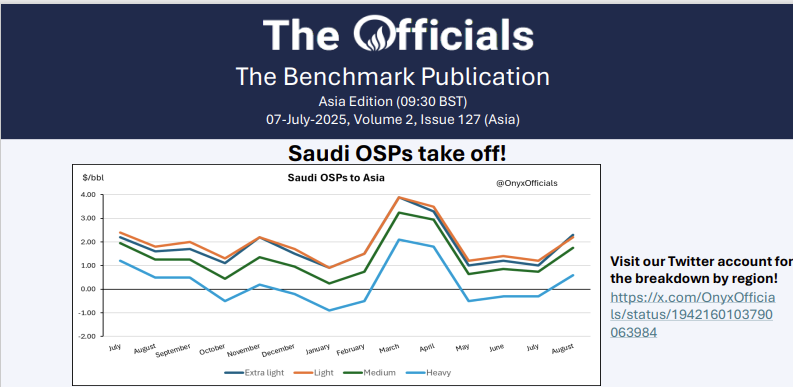

Dubai Market Report – Back to the Status Quo

The Dubai market has largely returned to normality as geopolitical risk unwinds. As per usual, the Strait of Hormuz didn't close this time, although there was noticeably more market anxiety. The forward curve is being heavily pressured, with Brent/Dubai boxes aggressively selling off. On the first day of July pricing, the Jul'25 Brent/Dubai fell below -$1/bbl, while the Jul/Aug'25 box came off to -$0.95/bbl, which marks an extreme contango structure. Aug'25 is following suit and was the next contract to fall below flat. Another notable drop was Q4'25/Q1'26, which fell from $0.05 to -$0.15/bbl. The market has largely disregarded the prospect of OPEC+ supply hikes, interpreting it as existing overproduction being formalised. The combination of the market buying Cal26 and selling front boxes would have put participants comfortably in the money. Here, trade houses and majors were the main players. Previously, we noted that refinery sell side hedging flows in Cal26 had distorted Brent/Dubai. Now that these flows have subsided, this distortion has left a vacuum conducive to a mean reversion. There is greater conviction in the downside for Brent/Dubai boxes as these flows are more speculative, whereas refinery flows are more price-agnostic.

Dubai Market Report – A Quiet Place

Given the return of geopolitical risk and the resulting hysterical volatility in the futures market, it has been a quieter-than-expected period in the Dubai market. In theory, Brent/Dubai was expected to crater on fears of supply disruption in the Middle East with the reignition of conversations around the potential closure of the Strait of Hormuz

Free Dashboards

Free Onyx Insights

Free Onyx Officials

Latest News

Onyx Alpha: June Review

Brent Forecast: 7th July 2025

ETFs Report